What is NSC-Dear friends, do you know that the post office runs a scheme in which you get more interest than tax free FD? Yes, you heard it right. We are talking about National Savings Certificate, which is also known as NSC in common parlance. Let us know about this scheme in detail.

What is NSC?

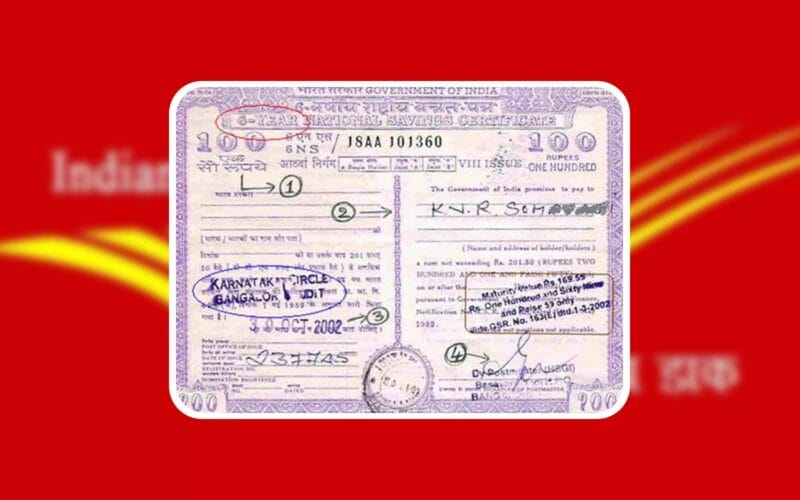

There is a 5 year deposit scheme in which you get guaranteed returns.

NSC is a deposit scheme in which you have to deposit money for 5 years. On this deposit you keep getting interest at a fixed interest rate with compounding. That is, you do not get fresh interest every year, but you get new interest on last year’s principal + interest.

The rate at which you have made your deposit will remain applicable till maturity, after this if the rates change then it will not be affected. This is because NSC is a scheme with guaranteed returns.

Also Read : Voter ID card lost? Here is Simple Steps to Make a Duplicate

You get more returns from tax free FD

At present, 7.7% annual interest is being given on NSC. If you talk about 5 year tax free FD of post office, then you get 7.5% interest on it. That means you will get 0.2% more return on NSC.

If you talk about tax free FDs of banks, the situation becomes even better. Only 6.5% interest is available in 5 year tax free FD of State Bank, Punjab National and Bank of India. That means you will get about 1.2% more return from NSC.

Talking about private banks, tax free FDs of HDFC and ICICI Bank offer 7% interest. In comparison to this, NSC will give 0.7% more returns.

You also get the benefit of tax exemption

The biggest advantage of NSC is that you can avail exemption on the amount deposited in it under Section 80C of the Income Tax Act. That means, if you have deposited Rs 1 lakh in NSC, then you can avail tax benefit of Rs 1 lakh.

Many people invest in tax free FD to save tax but there they get interest only on their principal amount whereas in NSC you will get tax exemption and the returns will also be higher.

NSC can be opened in the name of a child of any age.

There is no age limit for investing in NSC. You can also invest in this scheme in the name of your child, whether the child is newborn or 10 years old. The child himself can buy NSC in his own name after 10 years of age.

Many parents buy NSC in the name of their children so that a fixed amount can be saved for the child’s future. Because the child can use this money when he reaches the prescribed age.

opening process

It is very easy to buy NSC from the post office. You just have to go to your nearest post office, fill a form and deposit the amount. This scheme starts from a minimum of Rs 1000, but after this you can also invest in multiples of Rs 100.

There is no limit on the maximum amount. If you want, you can invest Rs 1 lakh, 2 lakh or even more in NSC. Two to three people can also jointly buy NSC.

Also Read : E-Challan Deception: How to Outsmart Scammers and Save Your Money

Rules for maturity and pre-mature withdrawal

NSC is a 5 year deposit scheme. This means that at the time of maturity, you will get back your entire investment along with compounded interest. You cannot withdraw any amount from it before 5 years.

However, you are allowed to make pre-mature withdrawal only in certain circumstances such as:

- On death of the account holder

- Seizure of account as a Gazetted Officer

- on court order

extension rules

If you want, you can extend NSC for another 5 years. For this you will have to go to the post office and buy a new certificate. The interest rate of that time will be applicable on this new certificate and not the old rate.

In this way, in total you can lock your money for 10 years. This will give good returns and the funds will also be safe.

invest wisely

Friends, NSC is definitely a great scheme but it is important to keep some things in mind. First of all, since it is a long term deposit, do not invest in it for your emergency fund or other important expenses.

Second, NSC is a guaranteed return scheme. Therefore, if you want better returns by taking more risk, then you can also invest in the stock market.

Ultimately the investment decision is yours to make. Diversify your entire portfolio considering your needs, risk appetite and return expectations. Remember one thing, the sooner you start saving and investing, the sooner your money will grow.

I hope I have tried to make you understand all the important points of NSC. If you have any questions in your mind, don’t hesitate to ask. Thank you!

Also Read : What is Gratuity? How to Calculate It, and Its Benefits and More

Skip to content

Skip to content