What is Klarna, Benefits– Online shopping has made our lives much easier. Now we can do online shopping while sitting at home. But sometimes payment options become a challenge. If you do not have a debit or credit card, it may be difficult for you to shop online. In such a situation, companies like Klarna can help you.

What is Klarna?

Klarna is a fintech company that offers customers various payment options for online shopping. It is a Swedish company which was established in 2005. Today it is available in more than 18 countries.

The following are the main benefits of Klarna:

- Try Before You Buy: Customer can make payment within 30 days after receiving the product. There is no interest or fee in this.

- Pay in 4: Customers can split their payment into 4 equal installments which are collected after every 2 weeks. No interest is charged here also.

- Flexible Financing: Payment can be spread over 3 to 36 months. Interest rate may be charged on this.

How does Klarna work?

Using Klarna is very easy:

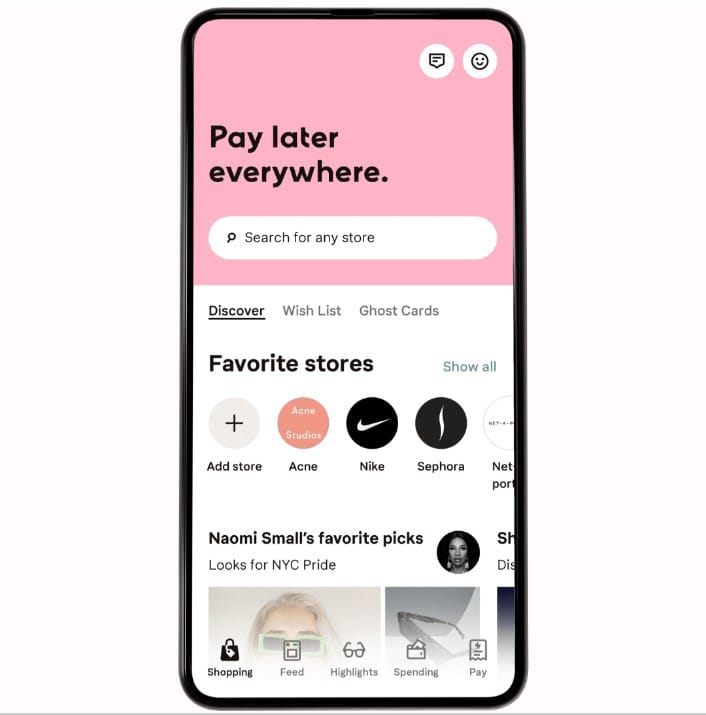

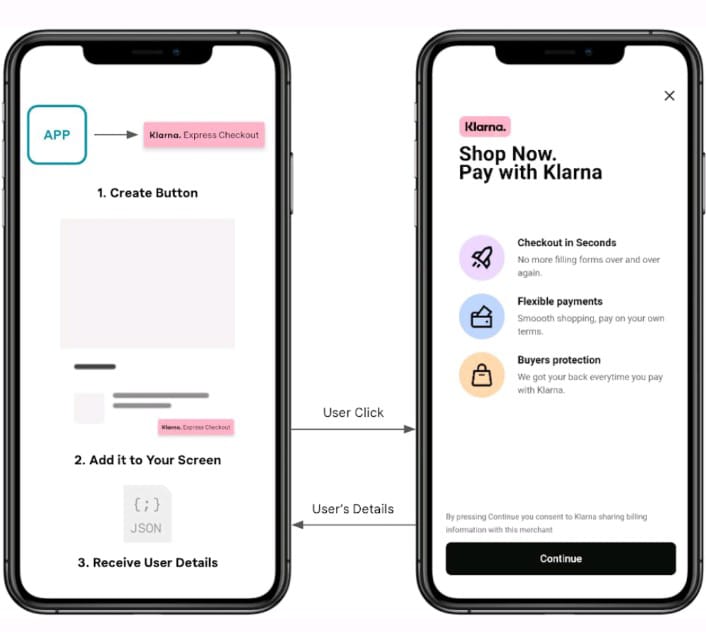

1. Download the app- First of all you have to download Klarna’s mobile app. After this create your account.

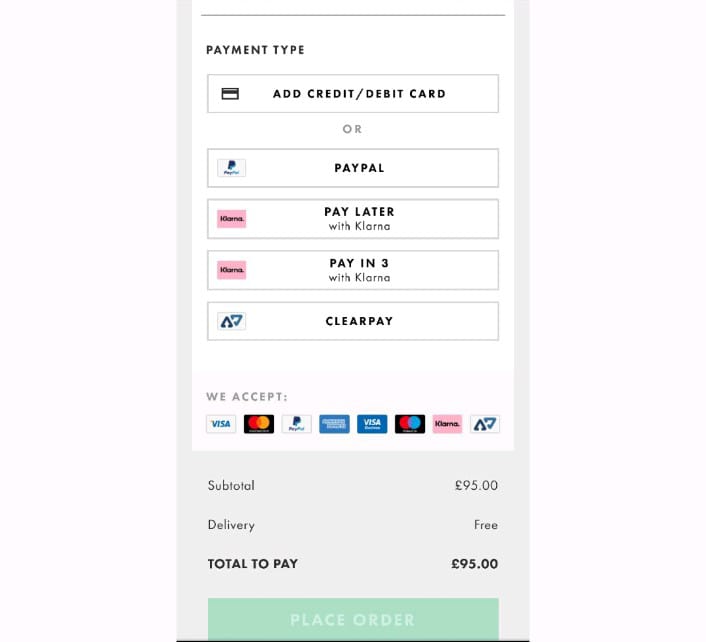

2. Shop – You can then shop at any online store of your choice. Select the ‘Klarna’ option at checkout.

3. Choose Payment Option – Now choose your choice from the available payment options – Pay in 4, Pay later in 30 days or for 3 to 36 months.

4. Confirm -You will receive a confirmation email from Klarna. From then on your order is complete!

It is a very easy and convenient way to shop online.

Benefits of Klarna

There are many advantages to using Klarna:

Flexible Payment Options -Klarna offers consumers flexible payment options. You can pay in installments instead of paying the entire amount at once.

No hidden charges – Klarna’s options like Pay in 4 and Try Before You Buy charge no interest or late fees.

Good Credit Score -If you make your payments on time it can help improve your credit score.

Safe and Trustworthy – Klarna is a regulated and legally recognized company that provides safe options for consumers.

Disadvantages of Klarna

However, some precautions should be taken when using Klarna:

Credit Risk -Interest and fees may accrue if you fail to make payments on time. This may increase your debt.

Danger of overspending -Klarna may encourage you to overspend. You should buy according to your budget.

Impact on credit score -If you miss payments, your credit score can suffer.

In which countries is Klarna available?

Klarna is currently available in the following 18 countries:

- United States of america

- Canada

- United Kingdom

- Germany

- France

- Netherlands

- Belgium

- Austria

- Sweden

- Norway

- Finland

- Denmark

- spain

- Italy

- poland

- Australia

- New Zealand

- portugal

Klarna is not currently available in India. But the company is planning to launch its services in India soon.

Who founded Klarna?

Klarna was founded in 2005 in Stockholm, Sweden by Sebastian Siemiatkowski, Niklas Adalberth and Victor Jacobsson. He is the founder of Klarna.

Today Klarna is a private company owned by its employees and investors. The company’s valuation is more than $60 billion.

Limitations on Klarna’s payment options

The financing limits available to you on Klarna depend on:

Credit Score –The better the credit score, the higher the limit you will get.

Payment History -If you have used Klarna before and have paid on time, you may get a higher limit.

Order Amount -The limit is higher for smaller orders, the limit may be lower for larger orders.

Demand – Demand on Klarna increases during festivals and sales, so limits may be reduced.

Can I shop on Amazon with Klarna?

Yes, you can also shop on Amazon using Klarna. But only with the ‘Pay Later’ option, wherein you can split your payment over a period of 3 to 36 months.

To do this, you must follow the following steps:

- Download the Klarna app and login

- Click on the ‘Shopping’ tab in the app and select ‘Amazon’

- Shop on Amazon like you normally would and add items to cart

- Click the ‘Klarna’ button at checkout

- Choose your payment plan and confirm the order

- You will receive a confirmation email from Klarna with payment details

This way you can easily use Klarna on Amazon!

Does Klarna charge or not?

Klarna doesn’t charge any fees for options like ‘Pay in 4’ and ‘Try Before You Buy’, provided you pay on time.

But for purchases for 3 to 36 months under the ‘Pay Later’ option, Klarna may charge the following:

- Initial Fee

- monthly service fee

- Rate of interest

- Penalty on late payment

You will see the total cost and monthly installments before you confirm the order. Select ‘Pay in 4’ or ‘Try Before You Buy’ to avoid charges and pay on time.

Why does Klarna application get rejected?

There are several reasons why Klarna may reject your application:

- Wrong personal information like name, email, phone number etc.

- Failing soft credit check

- Low credit score or poor payment history

- Too many open orders or outstanding balance

- High value order or long term payment plan

- Not supported by retailer or country

To avoid rejection, provide correct information and choose small orders and payment plans.

Is it safe to use Klarna or not?

Yes, it is completely safe and reliable to use Klarna. Klarna uses encryption and other security measures to protect customer information.

But, being online, there is always a risk of any fraud, cyber attack or theft. Therefore it is important to take precautions such as:

- use strong passwords

- Enable 2FA i.e. two-step verification

- Do not give your account details to anyone

- Do not click on suspicious emails or links

- Report any unauthorized activity

Requirements to qualify for Klarna

To use Klarna, you must meet the following requirements:

- 18 years of age or older

- Valid email address, phone number and billing address

- Debit/Credit Card or Bank Account

- Passing a soft credit check

- Payment options supported by seller and country

- Card or bank account issued in your country

Klarna does not accept everyone, so it is important to meet these requirements.

How to use Klarna?

To use Klarna, follow these steps:

- Download the Klarna app

- Create an account and provide personal information

- Choose the ‘Klarna’ payment option when shopping online

- Select your choice from the available options

- Receive confirmation from Klarna when the order is completed

- Pay in the app and track orders

It’s very simple and easy!

Skip to content

Skip to content