Choosing the Right Tax Form-Every year the Income Tax Department issues Income Tax Return (ITR) form according to the financial year. For the financial year 2023-24 also, the Income Tax Department has released ITR1, ITR2, ITR3 and ITR4 forms from April 1, 2024. Income tax return can be filed by filling these forms on the e-filing portal. The last date for filing income tax returns for the financial year 2023-24 is 31 July 2024. This means that you can file your income tax return till July 31, 2024 without any fees.

In this article we will understand in detail who should fill which ITR form. It is very important to know this because filling the wrong form can lead to penalty by the Income Tax Department. So let us know about these forms in detail.

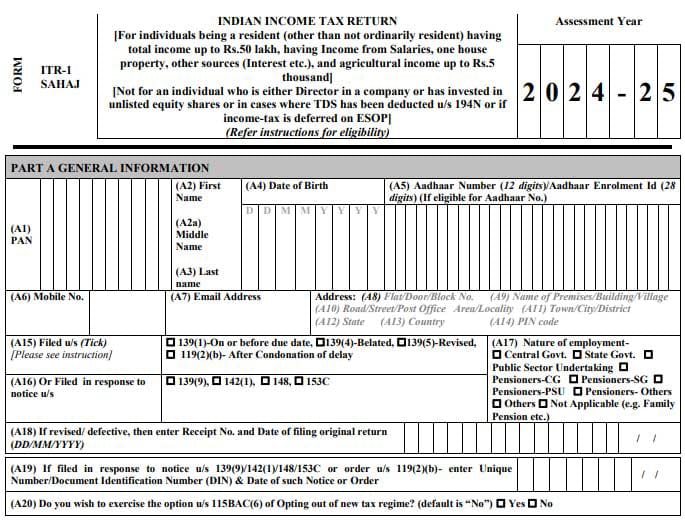

ITR1: Sahaj Form

ITR 1 or Sahaj form is for those whose annual income is less than Rs 50 lakh. This income can come from any source like salary, pension, house or property. Even if you are a farmer and have earned Rs 5000 from your farming, you can still file ITR 1.

ITR 1 is not for people who own more than one house property, who have made short term or long term capital gains, who have investments in businesses or unlisted companies. Also, if you are a businessman, HNI investor or director of a company, you cannot file ITR 1.

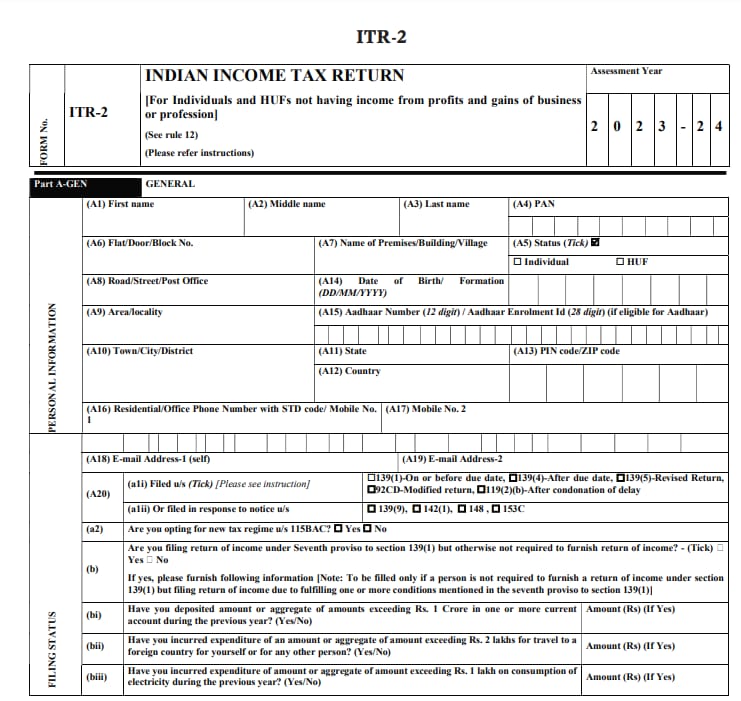

ITR2: Common Form

ITR 2 is for those whose annual income is more than Rs 50 lakh. This form is also for those who have made short term or long term capital gains, own more than one house property or have income from farming more than Rs 5000.

Additionally, if you earn income from horse racing betting, lottery or legal gambling, you should also file ITR 2. Also, if you have invested in any company or are a director of any company, you will have to fill the same form.

Also Read : What is NSC?: This scheme of post office is better than tax free FD

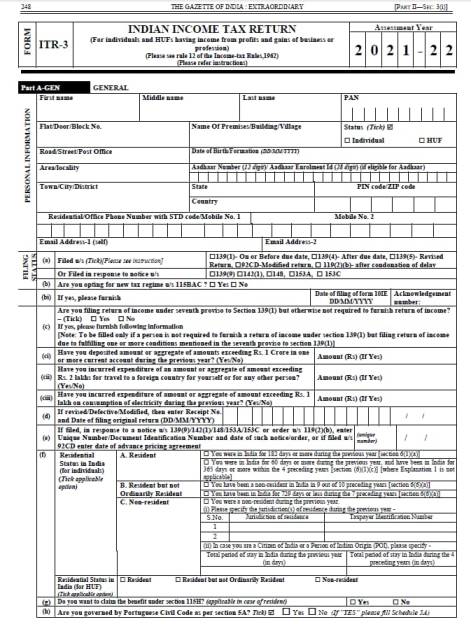

ITR3: Business and Professional Form

ITR 3 is for individuals and Hindu Undivided Families (HUF) who earn from their business or profession. This form is also for those whose income comes from ITR 2.

Even if you earn from shares of unlisted companies, you have to file ITR 3. Also, if your income is from salary, house property, capital gains, horse riding, lottery or legal gambling, you can also file ITR 3.

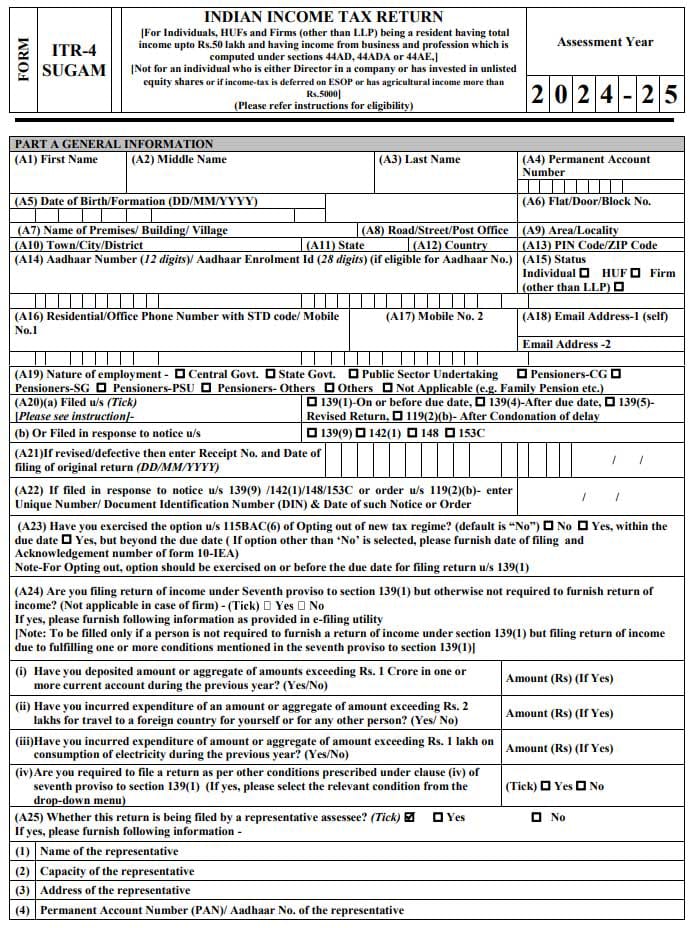

ITR4: Super Rich Taxpayer Form

ITR 4 is for individuals and HUFs whose annual income is Rs 50 lakh or more. Additionally, you should also file ITR 4 if your earnings fall under section 44AD or 44AE of Income Tax.

People filling this form can earn from salary, pension or any other source. ITR 4 is kind of for high income people. So if you earn Rs 50 lakh or more from any source then you have to file ITR 4.

Apart from these four ITR forms, forms like ITR5, ITR6 and ITR7 are also issued by the Income Tax Department. But most people need one of these four forms.

Also Read : LIC’s Saral Pension Scheme: A Lifelong Income Solution for Your Retirement Needs!

Skip to content

Skip to content